(© Hurca! - stock.adobe.com)

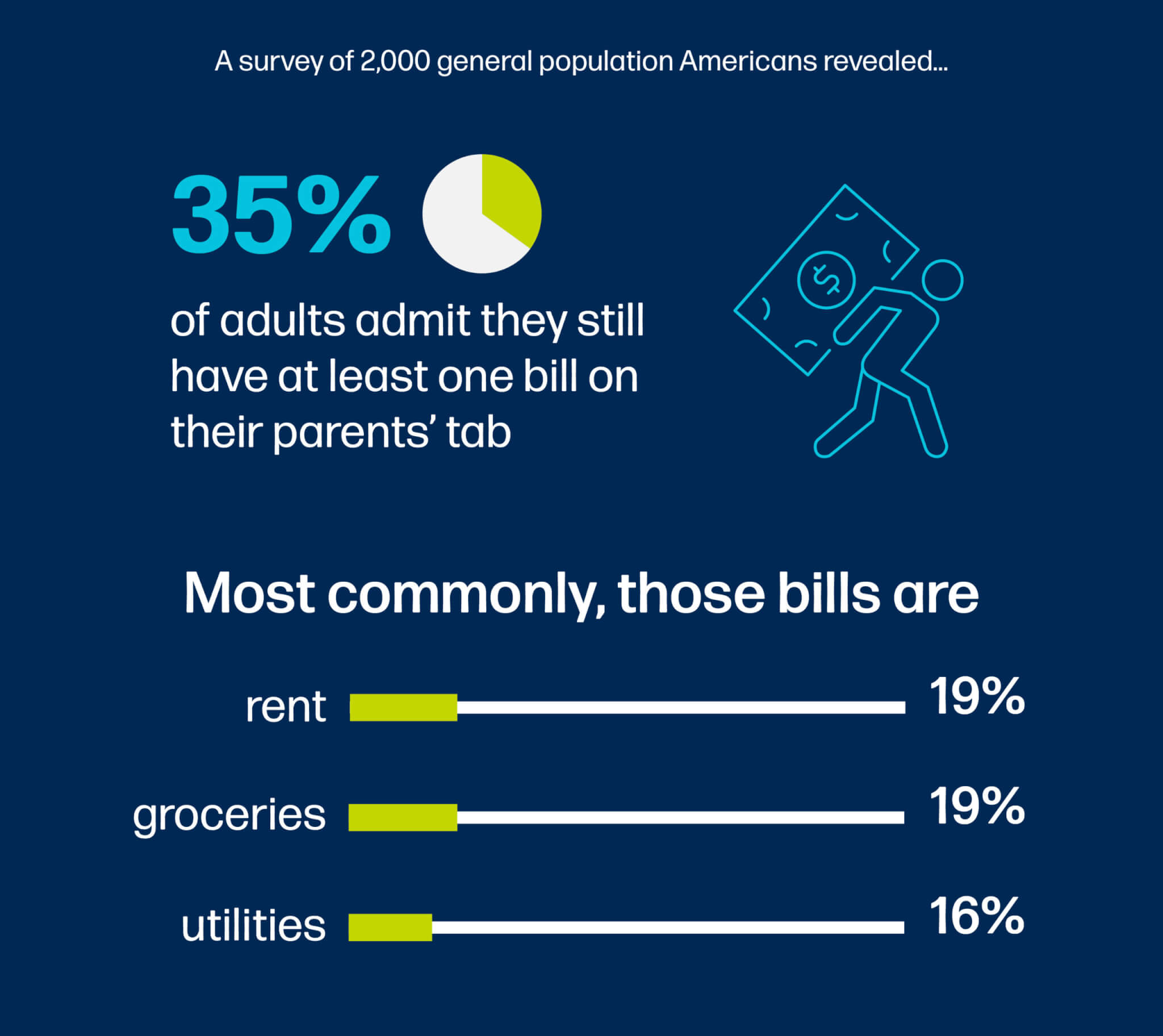

NEW YORK — More than one third of adults (35%) admit they still have at least one bill on their parents’ tab. According to a new poll of 2,000 Americans, the top three expenses their parents still pay for are rent (19%), groceries (19%), and utilities (16%). In fact, almost one-quarter (24%) of millennials say their parents cover their rent.

About three-quarters of those respondents (72%) vow to take these bills on themselves within the next two years, but 30 percent admit they will be riding their parents’ financial coattails until they’re told otherwise. Another 31 percent are trying to save money, saying it is cheaper to stay on their parents’ plan.

Conducted by OnePoll on behalf of Chartway Credit Union, the survey also shows that despite not managing all of their expenses, 85 percent of respondents consider themselves to be financially responsible. Most respondents (65%) consider having a good credit score to be an indicator of financial responsibility, but others weigh lack of debt (64%) and the amount they have in their savings (60%) as equally important.

In an average month, respondents say they have six different bills and expenses. Things like utilities (56%), food (66%), auto insurance (48%), internet (46%), and rent (43%) or a mortgage (40%) add up fast.

3 in 4 didn’t have a bank account as a kid

Almost three-quarters (73%) of respondents opened their first bank account by their 25th birthday, and 21 percent opened it before turning 18. Even though they may not have had a bank account, 30 percent of respondents started having their own money to spend by the time they were 15.

Respondents earned their first bit of spending money through an allowance from their parents (58%) and by picking up odd jobs around the neighborhood (56%). Almost seven in 10 (69%) in the Northeast earned money by helping neighbors, compared to only 43 percent in the Southeast – fewer than any other region.

“How to spend and save responsibly are lifelong lessons,” says Brian T. Schools, President/CEO of Chartway Credit Union, in a statement. “It’s noteworthy to see that over three-quarters of those surveyed have been managing their own money for most of their lives. Still, a third of respondents find it difficult to find helpful resources to manage their finances.”

Today, half of respondents struggle to limit unnecessary spending. They also face difficulty budgeting for unexpected expenses (45%) and remembering to pay bills on time (40%). On the flip side, only 32 percent of respondents struggle with their taxes and keeping their credit score high (26%).

Almost two in five (39%) millennials struggle to find resources or information that helps them with their finances, compared to only 11 percent of baby boomers – fewer than any other generation.

“While 85 percent of respondents see themselves as financially responsible when it comes to things like credit scores or savings, ironically, 50 percent of them struggle with unnecessary spending or unbudgeted expenses, and 40 percent struggle to remember to pay bills on time,” Schools observes. “Conflicting data such as this tells us that a lot more adults could benefit from some form of financial education, whether it’s provided in schools, online, or by their financial institutions.”

Survey methodology:

This random double-opt-in survey of 2,000 general population Americans was commissioned by Chartway Credit Union between Dec. 21 and Jan. 3, 2023. It was conducted by market research company OnePoll, whose team members are members of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).