Man stressed about money (© fizkes - stock.adobe.com)

NEW YORK — With the economic impact of COVID-19 throwing a wrench into the lives of countless people, many young Americans think their financial dreams are permanently out of reach. A new survey finds four in 10 adults under the age of 40 are not optimistic that they’ll ever achieve their financial goals.

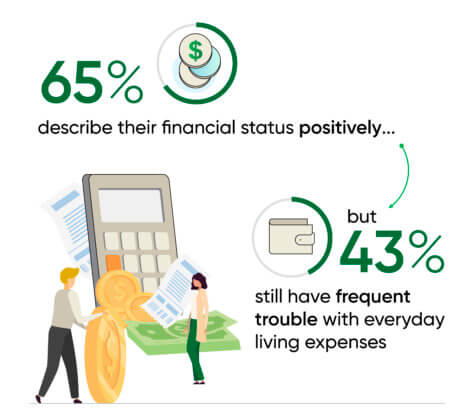

A OnePoll study asked 2,000 people between the ages of 18 and 40 to describe their financial fears and goals. Researchers also wanted to know how their experiences have been informed by previous generations. Forty-three percent say they frequently have trouble paying everyday living expenses, with 19 percent adding it happens to them “constantly.”

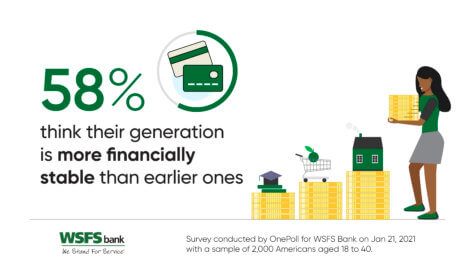

According to the survey, commissioned by WSFS Bank, many common monetary ambitions still feel out of reach for the nation’s Generation Z and Millennial populations.

Younger generations struggle with financial freedom

When it comes to financial setbacks, the majority of respondents worry about losing a job or taking a pay cut (48%), making bad financial decisions (40%), and needing to file for bankruptcy (39%). In fact, 58 percent said they actively avoid thinking about their finances out of fear that “they’ll mess it up.”

Six in 10 (59%), for example, are in sheer terror of the idea of having to apply for mortgages.

“While overspending is often the first thing that pops into consumers’ minds when they think of financial troubles, financial stagnation has played just as large a role in recent years,” says Vernita Dorsey, SVP and Director of Community Strategy at WSFS Bank, in a statement. “It’s never too late for any generation to prioritize money management to build financial stability and wealth for yourself and future generations. There is an abundance of educational content online to help build your financial confidence.”

How the past affected future financial goals

Despite these setbacks, 65 percent of respondents would describe their overall financial situation as either “good” or “excellent” and 58 percent think their generation’s level of financial stability is actually better than that of previous generations. However, those who are less optimistic about their generation’s financial stability cite the high costs of living, lack of job opportunities, income inequality, and issues with credit or debt.

Over half the poll (57%) also blame the previous generation’s mistakes for the country’s current financial system. Roughly one in three respondents, for example, believe that living through the housing crisis of 2008 had a huge impact on their financial behavior today. About the same number cite the current COVID-19 crisis (30%).

An even larger number of respondents say the 2015 mini-recession (39%), the Occupy Wall Street movement (38%), and the 2017 Tax Cuts and Job Act (34%) have impacted their financial habits.

“Unfortunately, Millennials and Gen Z have lived through many recessions and market disruptors causing additional financial stress and resulting in tighter job and economic markets,” Dorsey explains. “While these generations have proved to be resilient despite these crises, they’re left feeling that big financial goals, like buying a house, remain out of reach. With only 23% of respondents saying they learned financial skills in school, it is clear a financial literacy gap exists that, if addressed, could help build solid foundations prior to reaching adulthood.”